Welcome to the very first issue of The Weekly Climate! 🎉

This newsletter covers the week from August 10 to August 16 2020. Because this is the very first one I’m going to explain a few basics of the newsletter. First of all, the sections. The sections will likely change and adapt to new topics that arise but at this point the newsletter contains the following sections:

If you can only read one article this week

Climate & Science

Technology

Startups

Investing

Major Carbon Emitters

Politics

Climate Justice

Books

Other

Podcasts

Many of these are self-explanatory, but I just want to explain a few. In the “If you can only read one article this week” I highlight one article that I think is especially important from the previous week. In the “Major Carbon Emitters” I highlight news about the major carbon emitters i.e. mostly the fossil fuel industry but also other companies and organizations. This is because I believe that we all need to watch these very carefully. “Climate Justice” is a big catch-all category at the moment, but I believe that this is central to solving the climate crisis “right”. Especially when one look at the developing countries. Finally, the “Podcasts” category. Here I briefly summarize key climate crisis podcasts this week. If I’m missing yours, let me know.

Because this is the very first newsletter I’ve cherry picked a few items from the week before August 10 that are important in order to follow a few of the news this week.

Sent here by a friend or the podcast? Be sure to signup:

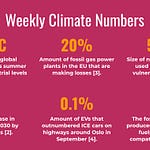

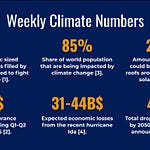

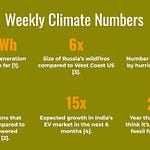

Executive summary — And now for a quick summary of the week. It has been a week full of good, bad and weird news. Among the good news are the $89B of stranded assets recently reported by seven of the oil majors, a UK solar company beats the world record in solar panel efficiency, and a report shows that renewable energy deployment have doubled over the past 5 years. On the bad side, the week saw the death of a famous climate scientist (due to an accident), the second hottest month ever recorded on the planet and the melting of Greenland ice sheets may have reached a point of no return. Among the weird were BPs announcement of winding down oil production and the following environmental movements applause.

Ok, here on to the main content!

‼️ If you can only read one article this week

Akshat Rathi uses his many years of reporting in the climate space to distill five key ideas to keep in mind when fighting the climate change. The 5 ideas are: (1) Adaptation without mitigation is futile, (2) To cut, first measure, (3) Focusing on blame slows progress, (4) Markets AND regulations, not vs, (5) Avoid technology lock-in. Everyone fighting the climate crisis should hold these dear to their heart, yet it is likely nr. 4 will make many in the environmental movement stomach churn. Nr. 3 resonated with me a lot. There’s so much tribalism going on still between different climate solution tribes. It’s so counterproductive.

👩🔬Climate & Science

A new study led by a couple of lead authors of recent IPCC reports indicates that air pollution is a more costly negative externality to burning fossil fuels than we thought. If we stop burning fossil fuels, quote: “The air quality ‘co-benefits’ are generally so valuable that they exceed the cost of climate action, often many times over.” The authors has quantified that stopping air pollution from burning fossil fuels will prevent 4.5 million premature deaths, 3.5 million hospitalization / emergency room visits, 350 million lost work days. And the study only look at the U.S. For the economy, these numbers mean a lot. The avoided deaths alone are valued at $37 Trillion, reduced healthcare costs are valued at $37 billion, and increased labor productivity is valued at $75 billion. Over the next 50 years this amounts to over $700 billion saved annually which adds a significant discount on the costs of mitigating and adapting to climate change. They even claim that the money saved from not polluting the air alone will pay for the mitigation and adaptation efforts of the climate crisis. The implications are huge. If this is true, then it means that solving the climate crisis will pay for itself. It also sounds a bit too good to be true. But what are we waiting for?

The climate science world has been shocked to learn about the death of Konrad Steffen who died as a result of an accident on Greenland. Police said he fell into a crevasse, likely excaserbated by climate change, and drowned in the deep water below. Konrad was a dedicated climate science scientist who’s known for his 40-year long career of studying the Arctic and Antarctic. He was one of the first scientists to sound the alarm about Greenlands melting ice sheet.

And more related bad news. A paper in Nature Communications Earth and Environment describes how the Greenland ice sheet has reached a point of no return, that even if global warming stopped today, then the ice sheet wouldn’t be able to sustain itself. Looking at data for the past 40 years the authors have determined that the snowfall that replenishes the ice sheet each year cannot keep up with the melting of the ice sheet. This is bad news, since if all Greenland ice melted it would result in 7m sea level rise.

In other sad news, albeit of a different kind: The U.S. National Oceanic and Atmospheric Administration (NOAA) reported that July 2020 was the second hottest month ever recorded on the planet, tied with July in 2016. The hottest month ever recorded is still July 2019, but only by 0.01C 👀. Can’t wait for July next year 😬. But by then temperature anomalies are probably going to be so normal that we’ll just shrug it off, just as we will shrug this one off.

🤖Technology

A detailed report from EMBER dives into how solar and wind energy now provides more and more electricity to the global energy grids. If you need a kick of optimism read this. What I find particularly encouraging is that globally installed renewables have doubled since 2015 from 5% to 10%. If we can keep it up then it’s looking pretty good, but it will still only put us at 40% by 2030. As the report also notes, the ramping down of coal is not going fast enough. Although coal is being replaced by renewables, we need to speed it up. By 2030 we need to be at 79% reduction from 2019 numbers. Also as a humble brag, Denmark, my home country, is number 1 at 64% of renewable electricity. Huttelihut as we say 🇩🇰.

Scientists have managed to make bricks power a small LED light. Yep, you read that right. Think about the good old potato battery, but with bricks. The fact that they managed to get it to work is a small but crucial step in proving the technology could work. Now the work begins in figuring out how to increase the energy storage capacity of the bricks. For this very first experiment it takes 50 bricks to power a 3 watt emergency light for 50 minutes. So there’s still some way to go get to MW scale storage. However, according to one Quora answer an average one storey home could contain as many as 8000 bricks, meaning that if the technology scales linearly, that the 8000 bricks could output 480 W for 50 minutes, or store the equivalent of ~400 Wh.

Oxford PV have beat the world record for the most efficient solar panel. The most efficient solar panel to date converts 22% of incoming solar energy to electricity, but Oxford PV beat that with their new panel which measured 27.6% efficiency 🥇. The panel is using a crystal first discovered in 1839 known as Perovskite, which not only makes the solar panel more efficient but also black instead of blue, which may make the panels blend in better with regular rooftops. Oxford PV expects to be able to bring the new solar panel to market in 2021.

As climate change progresses over the coming years we are likely to see more and more heat waves. California is experiencing one right now with temperatures above 37C (100F). This leads to high air conditioning loads, even during the evenings because it doesn’t cool down very much. This puts a strain on Californias state-of-the-art renewable grid, that aims to go zero carbon by 2045. The grid operator CAISO had to send out a Flex alert that asks consumers to limit power needs during friday evening due to lack of power. California has the U.S. highest amount of energy storage, 216MW to be exact, but even that amount is not enough to handle the evening peak. It’s likely only going to get tougher as California is also shutting down its only nuclear power plant, Diablo Canyon, in 2025. It just goes to show how important energy storage will be in a renewable energy future. Update August 15: The grid operator had to issue rolling blackouts friday night to reduce the load on the grid after a stage 3 emergency was declared. This is the first time this has happened since 2001.

💡Startups

A promising new battery technology by the company Form Energy is hoped to solve one of the biggest issues with energy storage: long duration storage. Long duration storage is currently prohibitive expensive to do with regular lithium ion batteries. Therefore, long duration storage is typically solved using fossil gas peaker plants, but if Form Energy’s technology works, then perhaps no more. Form Energy’s technology is based on “aqueous air”, which is a technology that the author of this newsletter must admit he has never heard about. But they just won a contract to deploy the first plant-sized version of the technology a 1MW / 150MWh plant in Cambridge, Minnesota. It’s going to be exciting to follow. If it works that’s going to make 100% renewable energy scenarios a lot more likely. (P.S. “Fossil gas” is the new “natural gas”, pass it on.)

Scottish heat battery startup Sunamp raises GBP4.5M to capitalize on growth market opportunities in global markets. The battery type is so called thermal storage and can store energy that can be released and used to heat water in the home and other applications. The thermal battery works great in association with solar panels on the roof for instance. The financing round is led by Chilean VC firm Aurus.

A new Swedish unicorn has appeared: Oatly. Oatly, which produces vegan food brands, has raised a round of financing that puts them at a valuation of 2B$. The 200M$ round was not without it’s raised eyebrows though. The round was led by Blackstone, which are known for having close ties with the Trump administration and for evicting a lot of people from their houses during COVID19, which according to the UN has exacerbated the housing crisis. According to some, Oatly is selling its soul. Oatly sees it as a way to put bad money to good use.

💰Investing

If you’re into startups and climate crisis you will without doubt have heard Jason Jacobs excellent podcast, My Climate Journey (MCJ) (if you haven’t, you know what to do now). Last week he announced that he’s raising a climate VC fund. Climate VCs are popping up all over the place now, so one can only assume there’s soon going to be a rush of entrepreneurs and startups to the space — for good and bad. But Jason Jacobs have fast become a go-to name in the space, so this can only be good.

Everyone held their breath as the COVID-19 crisis wreaked havoc on the financial system. How would the banks react especially many of those who promised to divest in the fossil fuel industry? But what ever you think of BPs announcement (see next item) it can only be good news in the fight against the fossil fuel industry that banks continue to believe fossil fuel industry to be a bad investment. Even after COVID-19. If only they would take even bolder action. Still, it’s a start.

⛽️Major Carbon Emitters

BP recently announced that it will wind down production of oil and gas by 30-40% by 2030 🤔. I should be celebrating together with all the environmental organizations, yet I’m not. In 2001 they changed their name to Beyond Petroleum, after a series of bad press and what exactly happened? Well they didn’t exactly move “beyond petroleum” if that’s what you’re thinking. Unless “beyond” means producing more petroleum than ever. But for some reason all the major environmental organizations from 350 founder Bill McKibben (in this article) to Greenpeace are clapping on the sidelines at their new announcement. I remain skeptical. Like highly incredibly skeptical. I think that two things are happening here: (1) As Bill writes in the article “BPs stock price soared 7 percent after the announcement” and (2) the environmental organizations needs to let their members know that what they’re doing works. The former is greenwashing, the latter is fair and applaudable. Culture Unstained (a research, engagement and campaigning organisation which aims to end fossil fuel sponsorship of culture) published an excellent piece on why we should be wary of “Better Petroleums” promises like this. The Energy Gang also discusses Better Petroleums announcement in their podcast this week, more info on that later.

Perhaps connected to the previous news item is the fact that seven top oil firms (BP among them) have downgraded their assets by $89B in the past 9 months 🎉. Oil firms blame government policies and COVID19 pandemic for the write-offs. It’s great news to see a substantial amounts of stranded assets. And it might be the only argument for believing Better Petroleums announcement. However, I have been unable to find out how many oil assets the same companies have in total. So although $89B sounds like a lot it, I would be interested in figuring out how big a percentage of total assets this is. If anybody knows, please let me know.

In the 90s 11 chinese chemical plants installed equipment to destroy a byproduct, N2O (a greenhouse gas 300x more powerful than CO2), which resulted from their production of various chemical products. Installing this equipment allowed the plant to sell carbon credits for disposing of the dangerous greenhouse gas (N2O). It was very lucrative as the equipment paid for itself in just 19 days of operation. However, as the carbon credit scheme ended, there was no longer any incentive to keep on running the equipment and N2O emissions continued on abated. Unfortunately, this is yet another story of carbon credits schemes being deployed in a bad and damaging way.

Stand.earth and Amazon Watch has published a report that accuses a number of big European banks for having double standards when it comes to climate change commitments. In the report Stand.earth and Amazon Watch says that the largest backers of a shipment of Ecuadorian crude oil to the US worth $10B were ING, Credit Suisse, Natixis, BNP Paribas, UBS and Rabobank. Any bank that directly finances operations like that in the Amazon rainforest are complicit in the growing threats to the rainforest. This stands in stark contrast to the April 7 2020 rupture of an Ecuadorian pipeline that caused one of the worst oil spills in the country’s history and in stark contrast to most of the banks climate change commitments.

The irony is really pouring out of this one. Apparently, climate change is poised to thaw the soil beneath a ConocoPhillips’ coming oil drilling project on Alaska’s North Slope, making its rigs and roads vulnerable to the same global warming which the project will be aggravating. The company’s solutions: Giant “chillers” should be deployed at the drill sites in order to protect the drill sites from thawing 🤦♂️.

🎩Politics

Saul Griffith (MacArthur Genius Award winner, founder of private research lab Otherlab in San Francisco, inventor, entrepreneur, and more) has made many public talks about energy and the climate crisis (such as this long and great one). He made this delicious Sankey diagram mapping all energy inputs to outputs of the U.S. economy. He and his team have been researching a big plan for how to decarbonize the U.S. economy 70-80% by 2035. The plan is big, bold, needed and a very interesting read and are being called the technical manual for the Green New Deal. One can only hope that somebody picks up the ball here in Europe. You can read a summary of the report here. Also this weeks Energy Gang podcast episode discussed the plan (more info on that later).

Big Oil is pouring millions into Trump campaign funds. Yeah. Let’s just hope that the era of Trump and fossil fuel industry is over soon. But it just goes to show how important the U.S. election in November will be. And furthermore:

Trump has removed legal requirements to monitor methane leaks by oil companies. I love the subtitle for this one: “Even Exxon Mobil and BP oppose the EPA’s decision to eliminate regulations on methane”. Listen, when your dick-ass fascist president is doing something that even the fossil fuel industry think is too much, maybe it’s time to get him out of office. But then again, I wonder whether the millions in campaign funds (from the previous news item) had anything to with this... I also don’t understand the “Protection” part of Environmental Protection Agency.

⚖️Climate Justice

Yet another assault on a forest by the fossil fuel industry is occurring in India. In developing countries there’s always a very difficult trade-off between providing electricity to its population and reducing carbon emissions. In many developing countries it’s not as simple as just using solar instead of coal, because jobs and local natural resources may suggest otherwise. But in this case it seems perverse as the article cites a study that indicates that not only is India the cheapest place to produce solar power, but a solar industry would also create 1.6M million jobs, which is way more than domestic coal production. But then again, India, has a Secretary for Coal, Maddirala Nagaraju. Seems like the fossil fuel lobby has a strong hand on this one.

📕Book reviews

The two main provocateurs of the environmental movement, Bjørn Lomborg and Michael Shellenberger, are back with two new books: False Alarm and Apocalypse Never. Bob Ward from The Guardian review them, and he’s not happy. Both Shellenberger and Lomborg are blamed of cherry picking facts and reaching lukewarm conclusions. I personally read Shellenberger’s book and although he’s ranting a bit you can’t argue with a number of the core facts in his book: (1) Environmental organizations and their fossil fuel associations, (2) the complete public disregard of nuclear power as a potential way to run our electricity grids in the future (if it can be done faster and cheaper) and (3) the tendency in the public discourse to completely overlook the developing world. And Bob Ward of the Guardian also agrees with this in his review.

📦Other

Paul McCartney signs up as an Earth Protector to stop Ecocide: If you haven’t heard about ecocide it’s started by now diseased lawyer Polly Higgins as an attempt to get ecocide (the destruction of nature) as a criminal offense. Here’s a brief primer on ecocide just in case: Video. It’s important that celebrities like Paul McCartney use their brand to stand up for important causes like this one.

🎧Podcasts

My Climate Journey - Episode 116 Philip Behn, CEO Imperfect Foods: Interesting insights into the food waste problem and how startups can help. Imperfect Foods source food from farmers that cannot be sold to supermarkets for various cosmetic reasons. Among the most interesting part of the podcast was the discussion about how Imperfect Foods measure their impact on climate change. They discuss how food waste can move around and how Imperfect Foods influence that.

Decouple - Swords to Ploughshares: How to get rid of nuclear weapons feat. James Conca: Dr. Keefer (MD) is back with another insightful episode about nuclear power. Did you know that 20.000 nuclear bombs has been used to power the U.S. electricity grid? In this episode Dr. Keefer talks with James Conca about how nuclear power plants can and has been used to turn disarmed nuclear bombs into cheap, clean and safe electricity.

Energy Gang - The Era of ‘Super-Hybrid’ Renewables for Oil Majors?: This one is actually from the previous week, but I think it was so interesting I decided to add it to this first issue as well. In this episode they discuss “Super-Hybrid” renewable energy plants. I went into it with the following attitude: “What are the oil majors up to now?!” but went out of it puzzled but optimistic. The episode discusses a renewable energy plant in the Netherlands that utilizes a wide array of technologies: Wind, floating solar, batteries and hydrogen production. It’s a very interesting approach to constructing a renewable power plant that has increased flexibility in terms of what it can do based on what’s available. What’s puzzling is that Shell is one of the partners in this plant.

Energy Gang - The economic case for electrifying everything: In this episode the Energy Gang discusses Saul Griffith et. al’s Rewiring America plan also mentioned earlier in this newsletter. The gang highlight a few things from the report like their ambitious cost reductions needed for nuclear and solar, and their job creation analysis. They also discuss leadership vs. new technology and what’s really needed. Apart from the Rewiring America plan the gang also discusses BP’s announcement mentioned earlier in this newsletter. They’re also sceptical that BP and the rest of the oil majors are going to be the one’s who will carry through our much needed energy transition.

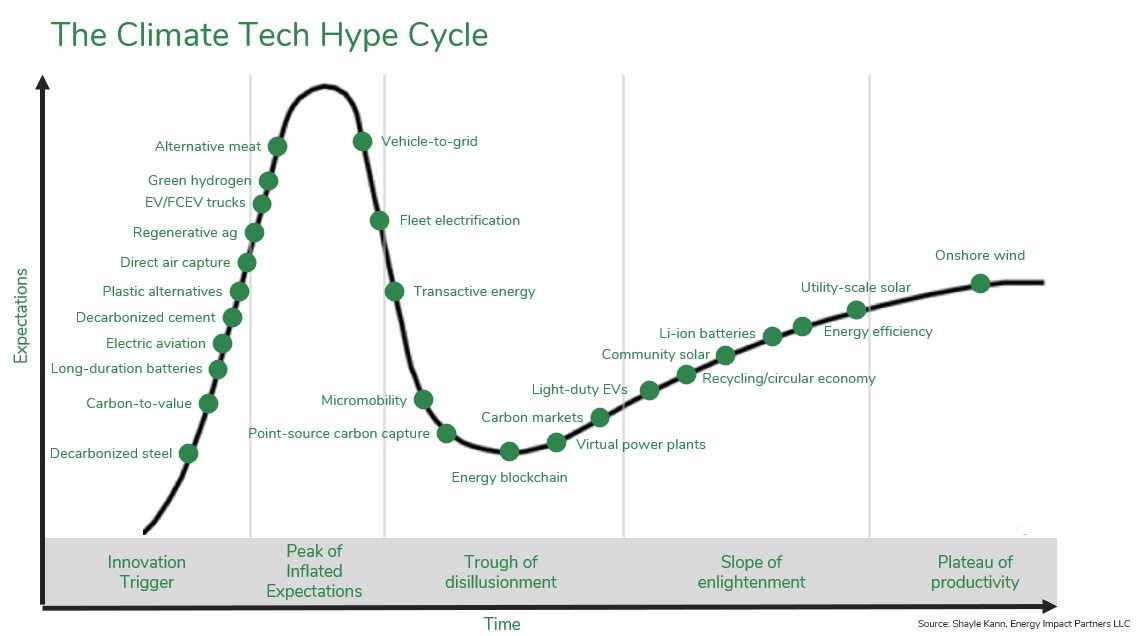

The Interchange - The ‘Climatetech’ Hype Cycle: Buy, sell or hold: Shayle Kann, managing director of Energy Impact Partners tweeted the above graph. It is the classic Gartner hype cycle graph where Shayle has mapped his views on different energy technologies. In this episode they go through a couple of technologies and discuss how hyped they are and whether they would buy (if it’s underhyped), sell (if it’s overhyped) or hold (if it’s just right in the goldilocks zone) these technologies. The technologies they go through and what Shayle and Steven would do with them are: Green hydrogen (hold, hype is high but warranted), micro-mobility (buy), residential energy storage (buy), direct air capture (sell (Steven), hold (Shayle)) and blockchain (Shayle: sell, Steven: hold). For what it’s worth I find the buy on micro-mobility weird from a climate perspective. It has been shown many times over that e-scooters are bad for the environment and climate in general. However, I really agree with their view on blockchain (and the rest of their calls btw). I was so in love with the technology, but it has got nothing to show for it.

That’s it for this week folks! If you feel like I’m missing something, please let me know.

See you all next week 👋

And if you haven’t already, remember to subscribe to the newsletter and the podcast.

The Weekly Climate #1: Aug 10-16 2020